Student Access Checking

Ditch the piggy bank and manage your money like a boss with features like Round-Up1, mobile banking, and digital wallet.

Get adulting before adulting gets you

We’re here to make adulting a little bit easier and a lot less scary. With no minimum balance and no direct deposit requirement, our Student Access Checking account gets teens (ages 13-172) started down the road toward financial independence.

Say goodbye to the bank of mom and dad

Our Student Access Checking offers a path to financial independence, with no account fees3 or minimums and no hassle.

- Round-Up makes saving easy—each debit card purchase is rounded to the nearest dollar, then the difference is transferred to your Student Access Savings. (No enrollment is needed to take advantage of Round-Up. To remove this feature, send us a message in online banking, stop by a branch, or give us a call at 800.533.2062.)

- No minimum balance requirement

- 24/7 account access, mobile banking, and mobile check deposit makes for fewer trips out of the way

The freeway between funds and fun

Our debit card makes it easy to pay or get the cash you need.

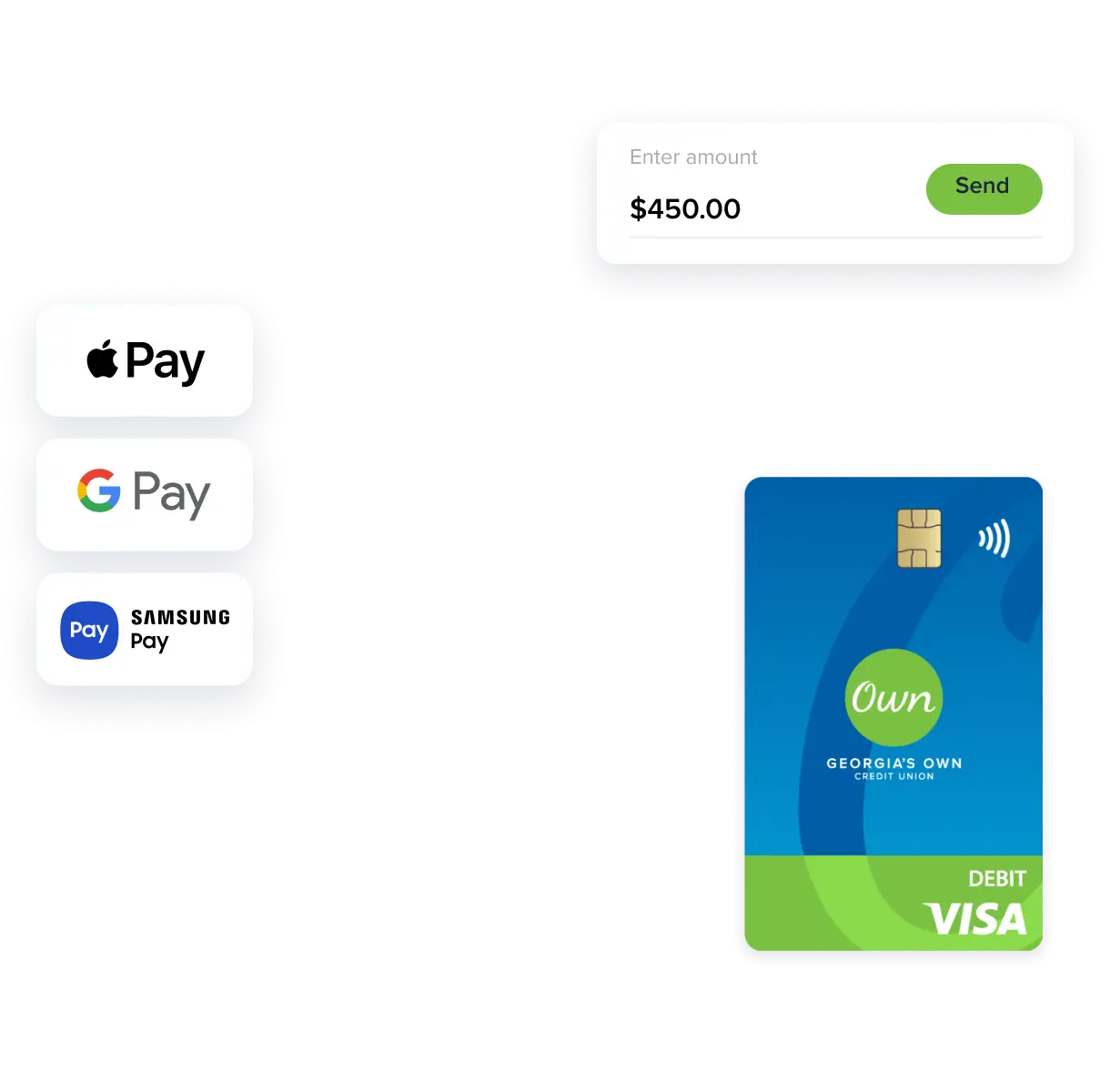

- Works with Apple Pay®, Samsung Pay®, and Google Pay™, so you can tap your way through life

- Visa’s Zero Liability4 policy helps ensure you only pay for what you buy

- Added security—your card is chip enabled and contactless, making purchases safer

- Text alerts keep you one step ahead of unauthorized use5

- Access to 30,000+ surcharge-free ATMs

Checking Account FAQs

Round-Up is a feature where we round up the amount of debit card purchases associated with your eligible checking account to the next whole dollar amount and transfer the difference from your Student Access Checking account to your Student Access Savings account. Debit card purchases include point-of-sale (POS), signature-based, PIN-based, and non-PIN-based transactions. Credit transactions (such as refunds from returned purchases) or adjustment transactions will not be rounded up.

Georgia’s Own will combine the Round-Up amounts from checking account purchases each business day and make a single transfer at the end of the business day into your eligible Student Access Savings account. If you don’t have sufficient available funds in your Student Access Checking account, or if any transaction has overdrawn your checking account, we won’t round up purchases posted on that business day and will cancel the daily Round-Up transfer.

If your debit card purchase is cancelled or reversed, such as a returned purchase, the corresponding daily Round-Up transfer amount will remain in your account.

Round-Up is included with Student Access Checking—no sign up needed!

You can remove Round-Up at any time by sending a secure message through online banking, by visiting your local Georgia’s Own branch, or by calling 800.533.2062.

When you turn 18 (and until you’re 22), you can contact us and have your Student Access Checking converted to an All Access Checking or Perks+ Checking account. On your 23rd birthday, your Student Access Checking will automatically convert to an All Access Checking.

In most cases, yes. Many online retailers will allow payment using your checking account information, like using your debit card. You can also make online purchases with your checking account information by verifying your account with a digital wallet or financial transaction app such as PayPal or Venmo.

Yes, you can apply for a checking account online. If you’re not a member of Georgia’s Own Credit Union, you will be able to apply for membership at the same time that you apply to open an account.

During the application process you will need:

- Your Social Security Number

- A valid U. S. driver’s license or other approved, government-issued I.D.

- Physical address information (P.O. Boxes can be used for mailing purposes, but a physical address is required for the online application)

- If under 18, an adult is required to open the account and be a joint owner.

Learn more about opening a checking account online.

Outside-of-the-box checking

Learning Center

Go beyond banking with resources and news to learn how to make informed financial decisions.

What’s the safest way to pay: check or debit card?

What is a certificate of deposit and is it right for you?

How to build your credit score

1Enrollment in Round-Up is automatic. You can remove Round-Up at any time by sending us a message in online banking, visiting a branch, or calling us at 800.533.2062. The Round-Up Program is currently available on the Student Access Checking account. The Round-Up Program is a feature where the Credit Union will round up the amount of debit card purchases associated with your eligible checking account to the next whole dollar amount and transfer the amount in excess of the purchase amount from your checking account to your eligible savings account. Debit card purchases include point-of-sale (POS), signature-based, PIN-based, and non-PIN-based transactions. The Credit Union will aggregate the rounded-up amounts from purchases that post to your checking account each business day and make a single transfer at the end of the business day into your savings account. If on a business day you do not have sufficient available funds in your checking account, or if any transaction has overdrawn your checking account, the Credit Union will not round up purchases posted on that business day and will cancel the daily Round-Up transfer for that day. If your debit card purchase is subsequently cancelled or reversed, such as a returned purchase, the corresponding daily Round-Up transfer will remain in your savings account. Credit transactions or adjustment transactions will not be rounded up. The Credit Union reserves the right to cancel or modify the Round-Up Program at any time in accordance with applicable laws and regulation.

2If under 18, an adult is required to open the account and be a joint owner.

3Enroll in eStatements and avoid the $5 per Mailed Statement Fee.

4Covers U.S.-issued cards only. Does not apply to ATM transactions, certain commercial card transactions, PIN, or other transactions not processed by Visa. You must notify Georgia’s Own immediately of any unauthorized use. For specific restrictions, limitations and other details, please contact Georgia’s Own.

5Georgia’s Own does not charge for this service, but please refer to your cell phone plan carrier for any text plan charges.