Visa® Classic

Credit made simple, with no annual fee1 and an affordable, competitive rate.

Because sometimes less is more

You don’t need a complicated relationship with your credit card. The Georgia’s Own Visa Classic is a straightforward, no-frills card that’s great for everyday spending, establishing credit, and paying your debt off fast. And we offer a secured option2 if you need it.

Your next-level credit card

All our credit cards include these essential features:

- No annual fee1 (yes, really!)

- Contactless payments for faster checkout

- Competitive rates that are some of the lowest around

- Discounts on top brands at more than 2,000 of your favorite retailers

- Simple online payments with Visa Click to Pay

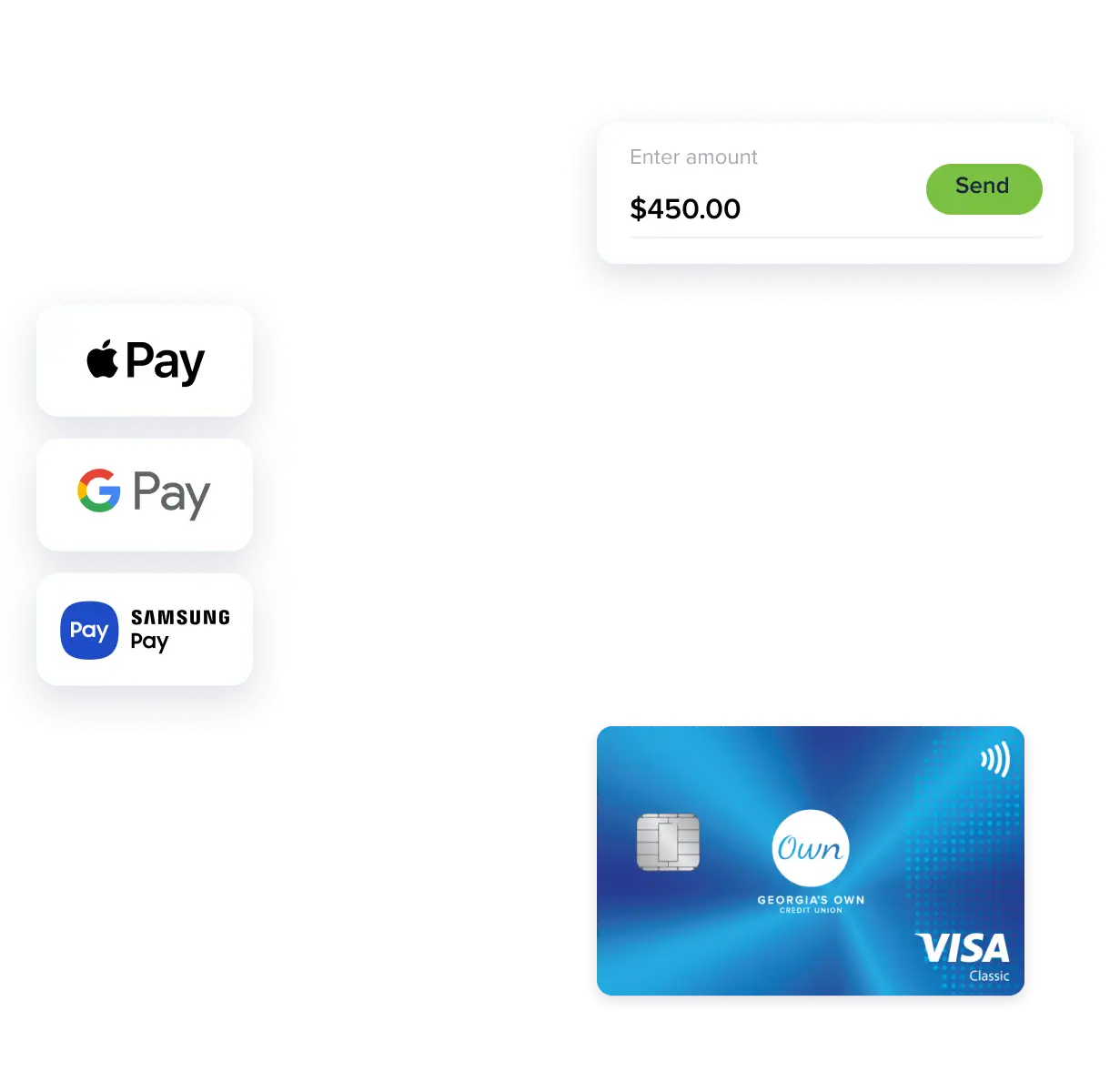

- Apple Pay®, Samsung Wallet®, and Google WalletTM compatibility

- Zero fraud liability3 and emergency card replacement

Doesn't it feel good to be in control?

Manage your card and protect yourself from fraud with the Georgia’s Own Card Manager app.

- View your transactions, balances, and available credit

- Pay your bill

- Customize your alerts and notifications

- Lock or unlock your card

- Report your card lost or stolen

- Set up spending controls

Credit Card FAQs

Yes, it’s simple and easy to make a payment on your Georgia’s Own credit card. Here are some of the ways you can pay your bill:

- Make a payment through online banking

- Use the Georgia’s Own Card Manager app

- Call our 24-hour automated pay-by-phone service at 866.597.1473

- Mail your payment to:

Georgia’s Own Credit Union

PO Box 71050

Charlotte, NC 28272-1050

Expedited Pay-by-Phone Fee: $8.00. If your account is subject to the Pay-by-Phone Fee, except as limited by applicable law, a fee may be imposed for method of payment is only allowed if the fee is for expedited crediting. This generally means the payments must be credited that day or if after the cut-off time established by the Credit Union, the following business day.

If your debit or credit card has been lost or stolen, or if you suspect fraud, call us right away at 800.533.2062. You can also send us a secure message through online banking. We will immediately block and reissue your card.

You can also lock or unlock your credit card yourself through the Georgia’s Own Card Manager app.

You can get Flex Rewards points on our Visa Signature®, Visa® Platinum, and Student Visa cards. Our Visa Classic card does not offer points.

To find the card that’s right for you, visit our Credit Card Comparison page.

Yes! We’ll even send you an additional card in the authorized user’s name. Just fill out and sign our Authorized User Request form, scan it, and return it to us (along with a copy of the authorized user’s ID) through the secure message center in online banking. You can also send the form by mail or fax, or drop it off at your local branch.

We offer a secured version of our Visa® Classic credit card for members who have a low credit score or no established credit. A secured card is “secured” by money in a savings account. This money then acts as collateral every time you make a purchase. As you use your credit card and pay your bills on time, those payments are reported to credit bureaus, which helps you establish credit and raise your credit score.

If you’re new to the world of credit, our Student Visa® could be a good option for you. It’s a great way to establish credit and build a credit history. You also earn Flex Rewards points for every dollar you charge, with a low rate and no annual fee.

Take a look at our other credit cards

Learning Center

Go beyond banking with resources and news to learn how to make informed financial decisions.

What are ancillary products (and are they really worth it)?

What is an adjustable-rate mortgage?

How to buy a new car without wrecking your finances

1Your Annual Percentage Rate (APR) may vary based on your creditworthiness. View our rates page for additional information about our variable rate Georgia’s Own Visa Classic. Standard variable APR for purchases, balance transfers, cash advances, and for penalty APR when it applies. Balance transfer fee is 3% of the balance transfer or $10 minimum, whichever is greater. Cash advance fee is 3% of advance amount. Foreign transaction fee is 2% of each multiple currency transaction in US dollars. Additional terms, conditions, and limitations may apply.

2A secured card allows those with low credit or no credit to have a credit card that is “secured” by money in a savings account.

3Covers U.S.-issued cards only. Does not apply to ATM transactions, certain commercial card transactions, PIN or other transactions not processed by Visa. You must notify Georgia’s Own immediately of any unauthorized use. For specific restrictions, limitations and other details, please contact Georgia’s Own.