Vacation and Holiday Savings

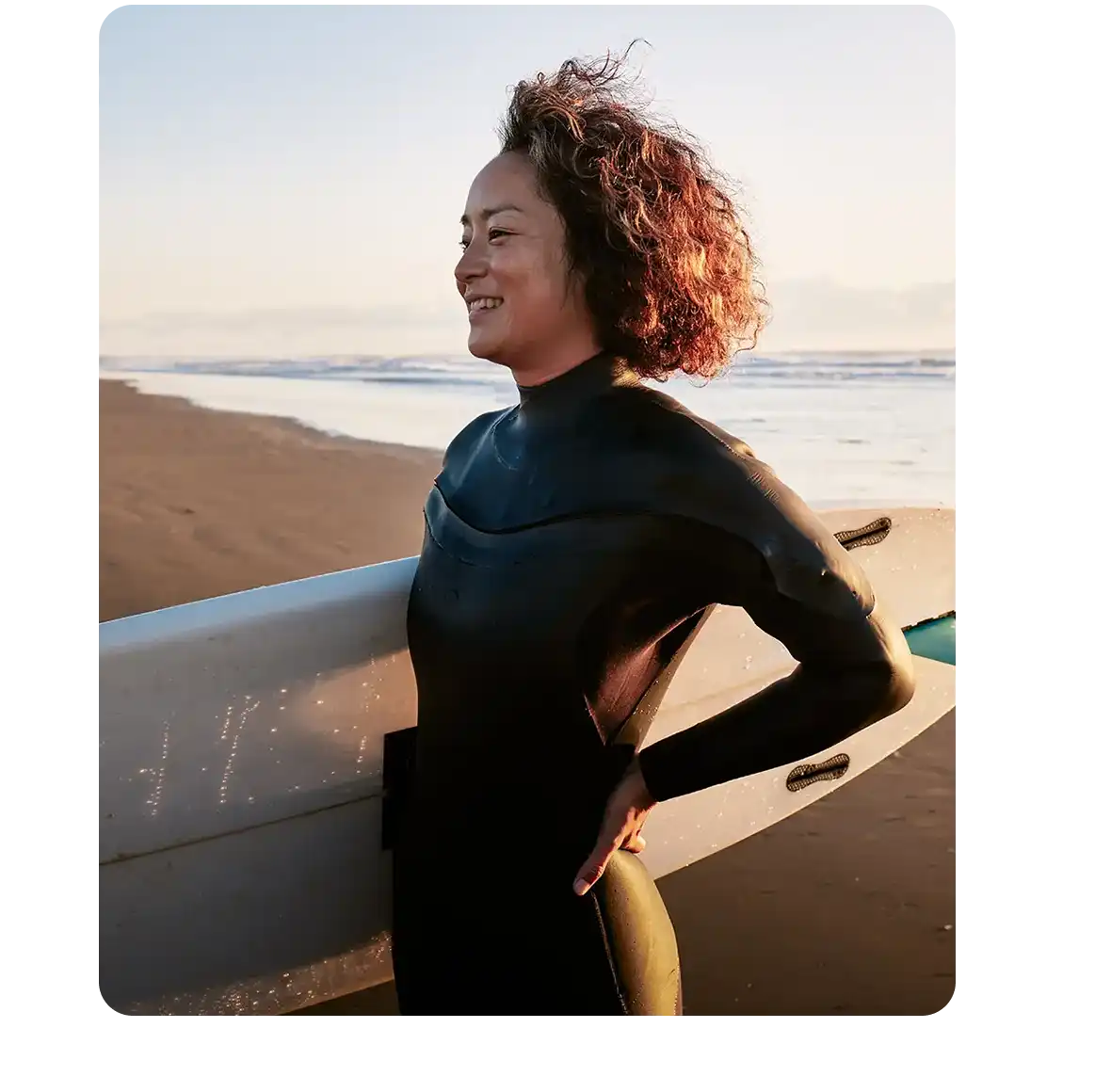

Beach day or ski slopes? Making your list (and checking it twice)? Save for it all—no mittens required.

Ditch the “bah-humbug” budget: spread holiday cheer (or vacation vibes) all year long

Stay on track with a dedicated account to stash your vacation or holiday savings:

- Your balance transfers automatically to your primary savings on May 1st for vacation savings or November 1st for holiday savings

- Direct deposit available

- Insured up to $250,000 by the NCUA

Track your savings on the go

Meet the ultimate time-saver: the Georgia’s Own mobile banking app. Available on the App Store® and Google PlayTM.

- Deposit checks

- Check balances

- Make transfers

- Find branches and ATMs

Savings FAQs

Yes, all members must have a primary savings account with a minimum balance of $5. This $5 refundable deposit represents your “share” in Georgia’s Own and is held on deposit as long as you are a member.

With tiered dividends, you get a better rate when you have a higher account balance. See our rates page for details.

Yes, your Georgia’s Own savings, checking, money market, and certificate of deposit accounts are insured up to $250,000 by the NCUA. For additional information, visit the NCUA share insurance estimator.

Level up your money game: check out more savings options

Learning Center

Go beyond banking with resources and news to help you make informed financial decisions.

What’s the safest way to pay: check or debit card?

What is a certificate of deposit and is it right for you?